Review: Commonwealth Bank Diamond Awards Mastercard

Disclaimer

Executive Traveller may receive a commission when you apply for these credit cards via our links.

The information provided on this page is purely factual and general in nature. You should seek independent advice and consider your own personal circumstances before applying for any financial product.

Notes

The Good

- Simplified earning rate: now earn points at the same rate, wherever you spend

The Bad

- No more AMEX, lounge access, and international transaction fees are back: but the annual fee hadn't gone down

Added Value

- The only credit card rewards program in Australia to offer United, JAL, Lufthansa & China Eastern miles transfers

Introduction

Being the highest-level points-earning plastic from Australia's largest credit card issuer, you might expect the Commonwealth Bank's Diamond Awards Mastercard to be one of the country's most rewarding products.

But hold that expectation and you'll be proven wrong, with CBA Diamond offering half as many frequent flyer points per dollar spent as some of its major competitors, and even worse earning rates with a new line-up of international partner airlines. Here's what you need to know.

Commonwealth Bank Diamond Awards credit card: fast facts

- Grade/tier: Black

- Card type: World Mastercard

- Loyalty program: Qantas Frequent Flyer Direct or Commonwealth Awards

- Qantas Points earned per $1 spent (Qantas Direct): 0.5

- Or, CBA Awards points earned per A$1 spent: 1.25

- CBA Awards points conversion partners: Virgin Australia Velocity (2:1), AirAsia BIG (2.5:1), Air France/KLM Flying Blue (3:1), Cathay Pacific Asia Miles (3:1), China Eastern's Eastern Miles (3:1), Etihad Guest (3.5:1), EVA Air Infinity MileageLands (3:1), IHG Rewards Club (2.5:1), JAL MileageBank (4:1), Lufthansa Miles & More (4:1), Malaysia Airlines Enrich (3.5:1), United MileagePlus (4:1).

- 1.25 CBA Awards points ($1 spent) = 0.625 Velocity points, 0.5 AirAsia/IHG points, 0.416 Air France/China Eastern/EVA Air miles, 0.357 Etihad/Enrich miles, 0.3125 JAL/Lufthansa/United miles.

- Points capping and restrictions: Earn up to 400,000 Qantas Points per year via QFF Direct, or 1,000,000 CBA Awards points, equal to 500,000 Velocity points. No points are earned on ATO payments.

CBA Diamond Awards: fees, charges and interest

- Base annual fee: $349

- Additional annual fee if earning Qantas Points: $30

- Additional/supplementary cardholder fee: $10/year

- Interest rate on purchases: 20.24% p.a.

- Interest-free days on purchases: Up to 55

- Interest rate on cash advances: 21.24% p.a.

- International transaction fee: 3.0%

- Minimum income requirement: No defined minimum

- Minimum credit limit: $15,000

Earning points for free flights:

Now positioned as a standalone Mastercard without a companion AMEX, CBA's Diamond Awards card serves up frequent flyer points in moderate quantities: but certainly not what we'd expect of a top-of-the-line card.

For example, spenders converting their credit card points into United MileagePlus miles would pocket less than 0.32 miles per $1 charged to the card: that's one mile per $3.20 spent on Mastercard, which isn't terribly rewarding – the best option being Velocity at 0.625 Velocity points per $1 spent, or one Velocity point for every $1.60 charged.

While it's great to see some harder-to-access program partners now attached to the CBA Awards scheme like JAL MileageBank and indeed, United MileagePlus, the poor conversion rates applied make using these programs unattractive compared to the local options – the exception being if you already have a chunk of miles in an offshore account, and just need to transfer a small amount more to unlock a meaningful reward, such as a business class flight.

In terms of Australian frequent flyer partners, CBA's earning rate of just 0.5 Qantas Points per $1 spent is half as generous as ANZ's top-tier Qantas credit card, for example, which provides one Qantas Point per $1 spent up to $7,500 per month before reverting to a 0.5/$1 earn rate, with a net $225 annual fee in the first year after getting $200 back on your card statement through the bank's latest sign-up offer, plus 75,000 bonus Qantas Points.

Or, for Velocity points, the ANZ Rewards Black Visa serves up the equivalent of one Velocity point per $1 spent (up to $5,000/month, halved thereafter) via the ANZ Rewards program, again with an advantageous annual fee of $275 in the first year after getting $100 back on your statement through the card's current sign-up deal, along with 75,000 bonus ANZ Rewards points, equal to 37,500 Velocity points.

The axing of CommBank's American Express cards – which had no international transaction fees for Diamond cardholders – also means you'll be hit with a 3% fee when shopping abroad using the bank's Mastercard, with no extra points provided in return.

Airport lounge access:

Airport lounge access is no longer offered with this card: a disappointing change, given CBA's annual card fee was not reduced when this benefit, and several others, were removed.

(If you're an existing CBA Diamond Awards cardholder and have a currently-valid CBA Diamond AMEX, you can continue to make use of your American Express lounge passes for access to AMEX's Sydney and Melbourne lounges until that AMEX card is cancelled on November 1 – but for new customers, CBA Diamond now comes as a Mastercard-only product.)

International travel insurance:

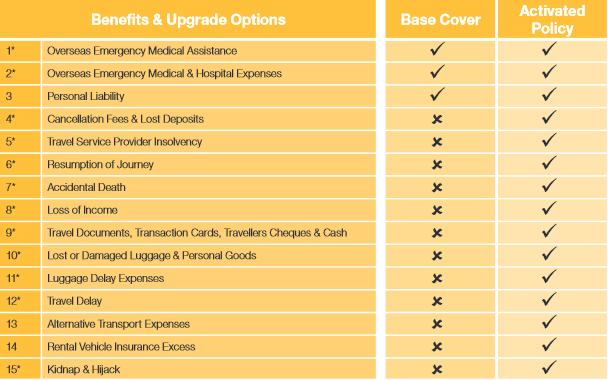

We’d expect no less than full international travel insurance from CBA’s top travel-themed credit card, and it’s there for you to take advantage of, provided you remember to manually activate it before each and every trip.

Unlike most other premium cards, coverage isn’t automatic when using your card to purchase your airfare or to pre-pay for hotel accommodation: if you don’t tell the bank where you’re travelling and when, you’ll only get overseas medical and personal liability insurance: not cover for travel delays, lost luggage or travel provider insolvency:

‘Activating’ cover after your journey begins comes with a three-day waiting period before the added perks kick in – but as there’s no requirement to use your card to pay for your trip, this opt-in system could be handy for business owners taking client- or company-funded tickets (where the business doesn't already provide travel insurance), or when jetting abroad on bookings made using frequent flyer points.

Commonwealth Diamond Awards: the verdict

CBA Diamond's previous advantage was its AMEX card with bonus points and no international transaction fees on overseas spend, but now as a Mastercard-only product, we can't see many reasons to apply.

For those chasing Qantas or Velocity points on Mastercard (or Visa) spend, there are more rewarding options out there – and those clued-in enough to want miles in programs like United would want these delivered at a much better rate, rather than being the less-rewarding choice.

As we flagged earlier, it's great to see CBA providing access to a greater number of international frequent flyer programs via their credit card rewards scheme, but given the generally poor conversion rates levied across the board, at present, these options are best-used for small top-ups to existing mileage balances, rather than starting from scratch with miles primarily earned through credit card spend.

Disclaimer

Executive Traveller may receive a commission when you apply for these credit cards via our links.

The information provided on this page is purely factual and general in nature. You should seek independent advice and consider your own personal circumstances before applying for any financial product.

24 Jun 2016

Total posts 7

This card is definitely a very poor proposition at the $349/year face value.

Qantas - Qantas Frequent Flyer

05 May 2017

Total posts 15

I've had this card for a long time now, and it used to be a fantastic point earner, but it has turned into utter rubbish ever since the RBA/Interchange fees saga last year which cut most of the points earning.

13 Apr 2018

Total posts 14

I also get this card for free with my home loan. Use it solely for the travel insurance- I think simply activating it is a LOT better than arguing with the insurance companies with other credit cards as to whether you have charged enough travel expenses to warrant coverage?

Qantas - Qantas Frequent Flyer

14 Sep 2012

Total posts 381

I have this card as part of my mortgage and I can confidently say this is the worst card on the market for anyone who even remotely considers themselves a business traveller.

14 Oct 2016

Total posts 105

I think commbank is still the largest issuer of cards which leads to terrible products like this. No perks (bar travel insurance) and one of the poorest earn rates for a card that cost $349 annually. Anybody who is at least partially savvy would only have this card if the fee is waved.

Virgin Australia - Velocity Rewards

20 Nov 2017

Total posts 114

Yeah, the only decent perk is the travel insurance, which is actually very good (better than the other majors' products) as long as you activate it each trip.

Hi Guest, join in the discussion on Commonwealth Bank Diamond Awards Mastercard